How to Value Your Seed-Stage Startup

The Foresight team regularly helps startup clients answer questions about Financial Modeling, IP Strategy, Valuation, and more. To share these insights, we created the Startup Q&A Blog Series. This article focuses on valuing an early-stage startup when preparing for seed investors.

Question: How Do I Value My Seed Stage Startup?

One client preparing for a seed funding round asked us the best way to value their business. Early-stage companies often lack operating history or revenue. This makes traditional valuation methods, such as discounted cash flow or revenue multiples, unreliable.

Our client is launching a smart wearable health tracking device and is aiming for a $12M pre-money valuation.

Step 1: Know the Current Market Comps

Since early-stage startups cannot be valued on cash flows, investors often look to the market to determine the “going rate” for businesses in a specific sector. Entrepreneurs should do the same.

-

Undervaluing your business can cause you to give up too much ownership.

-

Overvaluing your business may scare away investors before discussions even start.

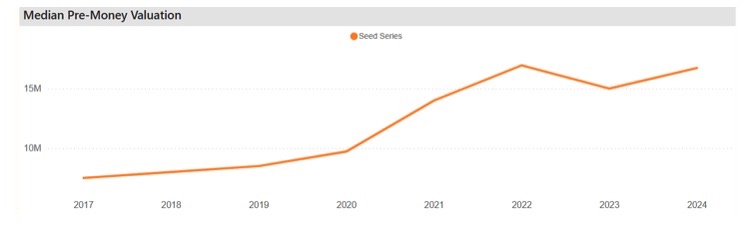

Starting negotiations from an informed position is key. Tools like the ColleyGO publication can provide data on median pre-money valuations. For example, the median seed-stage valuation in 2024 was $16.7M. Our client’s target of $12M puts them within a reasonable range.

Step 2: Know What Matters to Early-Stage Investors

Market comps are only the beginning. Most investors look deeper when valuing a startup. They evaluate specific characteristics of your business.

Dave McClure, founder of the accelerator 500 Startups, outlined a framework in 2011 assigning $1M of value to each of the following five components:

-

Market

-

Product

-

Team

-

Customers

-

Revenue

Today, these values are likely higher due to rising pre-money valuations. Each investor has their own heuristics.

When preparing your pitch deck, highlight your strengths. For example:

-

Strong founding team experience

-

Existing brand-name customers

-

Large or “hot” market opportunities

Our client has a particularly strong founding team, which is a major advantage when negotiating their target valuation.

Step 3: Consider Intellectual Property (IP)

A component often overlooked is Intellectual Property (IP). IP gives companies a competitive advantage and should be factored into valuation.

-

Include all forms of IP, not just patents.

-

Highlight brand strength, customer relationships, trade secrets, and customer data.

-

Even the potential to develop IP can increase perceived value.

Our client holds 2 design patents and 4 provisional patents, giving them additional leverage in negotiations.

Step 4: Hardware Startup Considerations

Hardware startups face unique challenges that software or service businesses may not. Some early-stage investors may hesitate to fund hardware ventures.

To overcome this:

-

Be creative with your business model. Consider subscriptions, upgrades, or other ways to increase recurring revenue.

-

Integrate software where possible. Even a simple app can provide additional revenue streams, data collection, or community engagement.

-

Be mindful of wording. Replace terms like “hardware” with “device” or “delivery mechanism” to keep investors engaged.

For our client, these adjustments helped present their wearable device in a way that minimized investor hesitation.

Conclusion

Valuing a seed-stage startup requires combining market comps, investor priorities, IP, and the specifics of your business model. Early preparation, clear communication, and emphasizing differentiators can help founders negotiate a fair pre-money valuation.

By following these steps, entrepreneurs can confidently approach investors and justify their valuation with both data and strategic narrative.